Introduction to Financial Models

In this article, we explain how to build a financial model and why are they important in today’s business world. Financial models form the backbone of making robust business decisions in today’s competitive market landscape, especially for a startup. These models are sophisticated tools that enable businesses to predict financial outcomes, optimize operations, and allocate resources efficaciously. Financial models are essential for various stakeholders including business managers, investors, and financial analysts.

A financial model often employs mathematical formulas and assumptions to convert historical data into predictive insights. Three core components characterize these models:

- Inputs: This includes historical financial data, market trends, and assumptions about future performance.

- Logic: The set of rules or algorithms that process the inputs to produce outputs.

- Outputs: The projections or scenarios generated, such as revenue forecasts, valuations, and risk assessments.

Financial models broadly fall into several categories, each serving unique purposes:

- Discounted Cash Flow (DCF) Models: Used primarily for valuing investments or companies by forecasting free cash flows and discounting them to present value.

- Comparable Company Analysis (CCA): Involves comparing the financial metrics of similar companies to identify valuation multiples for benchmarking.

- Budgeting and Forecasting Models: Employed for planning future revenues, expenses, and profitability by projecting current financial data.

- Leveraged Buyout (LBO) Models: Tailored for assessing the feasibility of acquiring a company by leveraging debt instruments.

The evolution of financial models has been significantly influenced by advancements in technology. Tools like Microsoft Excel, specialized financial software, and data analytics platforms enable more accurate and efficient model building. Best practices in financial modeling emphasize the importance of being detailed, consistent, and transparent.

In conclusion, understanding financial models is pivotal for anyone involved in the financial industry. They offer invaluable insights that aid in making informed business decisions. Technological advancements continue to refine these models, increasing their reliability and application across various sectors.

The Importance of Financial Models

Financial models serve as vital tools in today’s business environment, providing essential insights for decision-making and strategic planning. They are designed to represent a company’s financial performance and forecast future outcomes based on various assumptions, becoming indispensable for numerous stakeholders.

Decision-Making and Strategy

Financial models equip management teams with the necessary data to make informed choices. By simulating different scenarios, these models aid in identifying optimal business strategies, evaluating potential investments, and preparing for future financial conditions. This enables companies to navigate complexities and uncertainties effectively.

Risk Management

Understanding and mitigating risk forms a core aspect of business operations. Financial models play a crucial role in this by estimating potential risks associated with various decisions, such as market fluctuations, interest rate changes, or new business ventures. Quantifying these risks allows businesses to develop risk mitigation strategies in a proactive manner.

Performance Measurement

Assessing and measuring performance is another critical function of financial models. These models help in tracking key performance indicators (KPIs), understanding variances from expected outcomes, and identifying areas for improvement. This continuous monitoring contributes to better operational efficiency and financial health.

Attracting Investors

Attracting investments requires a comprehensive presentation of financial health and future profitability. Financial models present a coherent storyline about a company’s financial prospects, providing potential investors with a clear view of the expected returns, growth trajectory, and associated risks. This transparency boosts investor confidence.

Budgeting and Forecasting

Effective budgeting and forecasting form the backbone of operational planning. Financial models facilitate the creation of detailed budgets and forecasts, incorporating all financial aspects of the business. They ensure alignment of resources with strategic goals, allowing organizations to plan ahead and allocate resources wisely.

Valuation and Mergers & Acquisitions

Financial models are indispensable in the valuation of companies, whether for internal assessments or during mergers and acquisitions (M&A). They offer a structured approach to determine the worth of a business, ensuring fair negotiations and informed decision-making during M&A transactions.

In summary, financial models are essential for contemporary businesses, driving decision-making, risk management, performance tracking, investment attraction, strategic planning, and valuation. Their application spans across various business functions, reinforcing their indispensability in the commercial landscape.

Key Uses of Financial Models

Financial models play a pivotal role across a myriad of business activities. Their applications span from strategic planning to operational decision-making. Here are key uses of financial models:

Valuation of Assets and Companies

Various models, such as Discounted Cash Flow (DCF) and Comparable Company Analysis, are employed to determine the fair value of assets, projects, or entire companies. This is vital for M&A activities and investment decisions.

Budgeting and Forecasting

Companies use detailed financial models to create budgets and forecasts. These models help predict future revenues, expenses, and cash flows, providing a roadmap for financial planning and resource allocation.

Risk Management

Financial models assess potential risks related to investment portfolios, market changes, and business operations. They quantify risks and develop strategies for mitigation, which are essential for maintaining financial stability.

Scenario Analysis and Stress Testing

By inputting various assumptions and scenarios into a financial model, businesses can analyze outcomes under different conditions. This includes examining the impact of economic downturns, regulatory changes, or competitive developments.

Capital Raising

Organizations leverage financial models to present their financial health and projections to potential investors and creditors. This is critical for securing equity or debt funding and negotiating favorable terms.

Performance Measurement

Financial models are used to measure and evaluate the performance of different departments, projects, and initiatives within the company. This helps in identifying strengths and areas for improvement to optimize operations.

Strategic Planning and Decision Making

Models offer a quantitative foundation for forming strategic business decisions. They assist in evaluating the feasibility and financial impact of strategic initiatives like entering new markets, launching new products, or restructuring operations.

Mergers and Acquisitions (M&A) Analysis

In M&A transactions, financial models provide critical insights into the financial implications of potential deals. They aid in determining synergies, payment structures, and the financial outcomes of integration efforts.

Financial models are indispensable tools that facilitate informed decision-making, risk management, and strategic planning in today’s complex business landscape.

Understanding Different Types of Financial Models

Financial models serve various purposes across different business scenarios. Understanding the types of financial models helps businesses make informed decisions.

Discounted Cash Flow (DCF) Model

A key tool in valuation, the DCF model calculates the value of an investment based on its expected future cash flows. The model discounts these cash flows back to the present value using a discount rate.

Comparable Company Analysis (Comps)

The Comps model involves valuing a target company by comparing it to similar publicly traded companies. This method uses valuation multiples such as Price-to-Earnings (P/E) and Enterprise Value-to-EBITDA (EV/EBITDA).

Precedent Transactions Analysis

This model determines the value of a business by looking at historical transactions of similar companies. It focuses on past acquisitions in the industry and provides insights based on acquisition prices.

Leveraged Buyout (LBO) Model

Used primarily in private equity, the LBO model evaluates an acquisition using significant amounts of borrowed money. The model forecasts cash flows to service the debt, enabling the investor to understand the potential returns from the leveraged buyout.

Mergers and Acquisitions (M&A) Model

The M&A model is employed to analyze the potential financial impact of a merger or acquisition. It assesses the combined entity’s financial performance and envisages the synergy effects from the transaction.

Three-Statement Model

This model integrates the income statement, balance sheet, and cash flow statement into one interconnected financial model. It is a fundamental tool for internal financial forecasting and analysis.

Option Pricing Model

Option pricing models, such as the Black-Scholes model, calculate the value of options. These models consider factors like stock price, exercise price, volatility, and time to expiration.

Budget Model

The budget model helps businesses plan their financial activities for a specific period, typically a fiscal year. It forecasts revenues, expenses, and profits, setting expectations and financial targets.

Forecasting Model

These models predict future financial performance based on historical data and assumptions about future conditions. They are essential for strategic planning and financial management.

Understanding these models equips businesses with the tools needed to navigate complex financial landscapes and make data-driven decisions. Each model serves a distinct purpose and offers unique insights into financial health and potential opportunities.

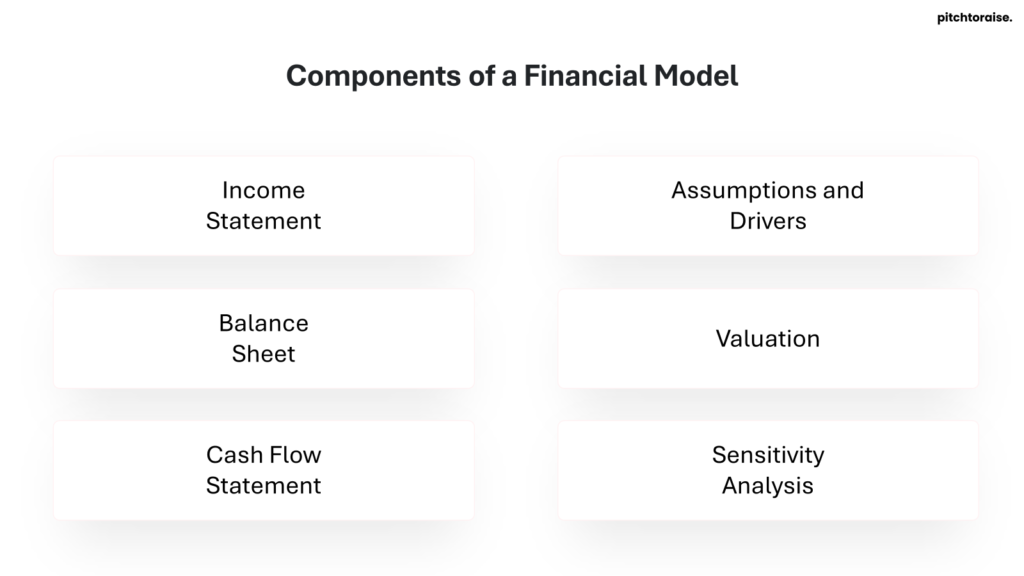

Components of a Financial Model

Financial models consist of various interconnected components that help in projecting a company’s financial performance. Each component serves a specific purpose in providing a detailed and comprehensive analysis. The primary components include:

Income Statement

The income statement, or profit and loss statement, outlines the company’s revenue, expenses, and profits over a specific period. It includes:

- Revenue: Total sales generated from business operations.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Operating Expenses: Indirect costs such as salaries, rent, and utilities.

- Net Income: Profit after all expenses, taxes, and costs have been deducted from revenue.

Balance Sheet

The balance sheet portrays the company’s financial position at a specific point in time. Key elements include:

- Assets: Resources owned by the company (current and non-current).

- Liabilities: Obligations the company owes to external parties (current and long-term).

- Equity: Shareholders’ residual interest in the company after liabilities are deducted from assets.

Cash Flow Statement

The cash flow statement tracks the movement of cash in and out of the business. It is divided into three sections:

- Operating Activities: Cash received or spent in regular business operations.

- Investing Activities: Cash used for or generated from long-term investments.

- Financing Activities: Cash flows from transactions with the company’s investors or creditors.

Assumptions and Drivers

Assumptions and drivers are critical for predicting future performance. These include:

- Revenue Growth Rate: Percentage increase in revenue over time.

- Expense Growth Rate: Predicted growth in operating expenses.

- Interest Rates: Assumed cost of borrowing impacting financial projections.

- Tax Rates: Projected taxes affecting net income.

Valuation

Valuation methods estimate the present value of future cash flows generated by the business. Common methods include:

- Discounted Cash Flow (DCF): Calculates the present value of projected future cash flows.

- Comparable Company Analysis: Valuation based on metrics of similar companies.

- Precedent Transactions: Valuation derived from historical deals in the same industry.

Sensitivity Analysis

Sensitivity analysis examines the impact of variations in assumptions on the financial outcomes. Important factors include:

- Assumption Variability: Changes in revenue, costs, and interest rates.

- Scenario Analysis: Best, worst, and base case scenarios to assess robustness.

These components together build a comprehensive financial model, providing a framework for informed decision-making and strategic planning in today’s complex business environment.

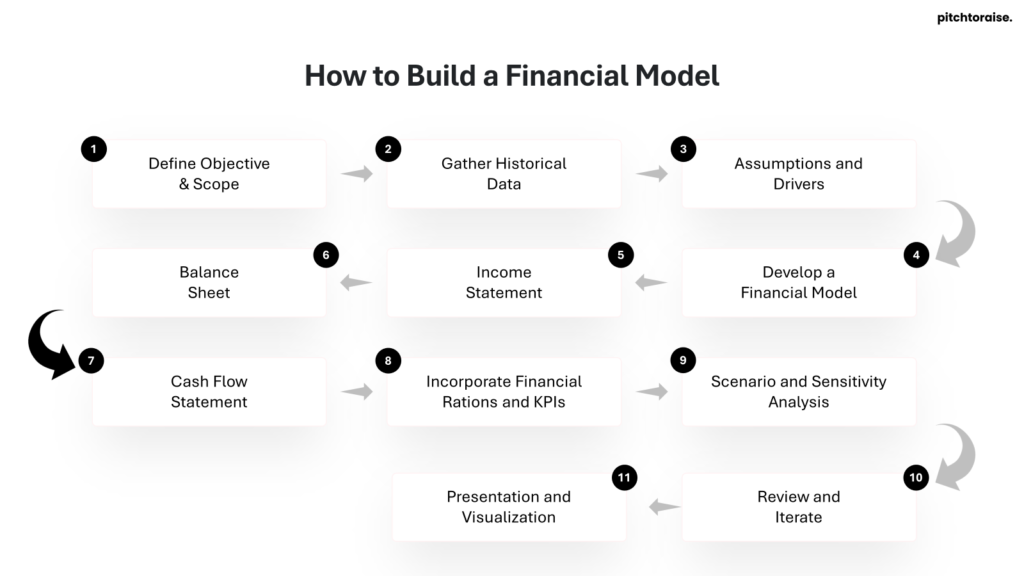

How to Build a Financial Model

Building a financial model is a multi-step process that requires both precision and foresight. The steps outlined below provide a comprehensive approach to developing a robust financial model.

- Define Objective and Scope

- Identify the primary goal of the financial model.

- Determine the time frame and level of detail required.

- Gather Historical Data

- Collect financial statements and relevant historical data.

- Ensure data accuracy and completeness.

- Assumptions and Drivers

- Define the key assumptions such as growth rates, cost inflation, and interest rates.

- Identify the main drivers that will impact the business performance.

- Develop a Financial Forecast

- Build revenue models based on historical data and market analysis.

- Project operating expenses, CAPEX, and working capital requirements.

- Income Statement

- Forecast revenues, COGS, gross profit, operating expenses, and net income.

- Structure it to show quarterly or annual projections.

- Balance Sheet

- Project assets, liabilities, and shareholders’ equity.

- Link the balance sheet with the income statement and cash flow statement.

- Cash Flow Statement

- Separate cash flows into operating, investing, and financing activities.

- Ensure changes in working capital and other adjustments are reflected.

- Incorporate Financial Ratios and KPIs

- Calculate key financial ratios such as ROE, ROA, and liquidity ratios.

- Integrate KPIs to track operational efficiency and financial health.

- Scenario and Sensitivity Analysis

- Develop different scenarios based on varying assumptions.

- Perform sensitivity analysis to assess the impact of changes in key assumptions.

- Review and Iterate

- Review the model for errors, inconsistencies, and plausibility.

- Obtain feedback from stakeholders and refine the model accordingly.

- Presentation and Visualization

- Use charts, tables, and dashboards to present model outputs.

- Ensure clarity and accessibility for decision-makers.

Building a financial model is an iterative process that involves critical thinking and continuous improvement. The model should be flexible enough to accommodate new data and evolving business conditions.

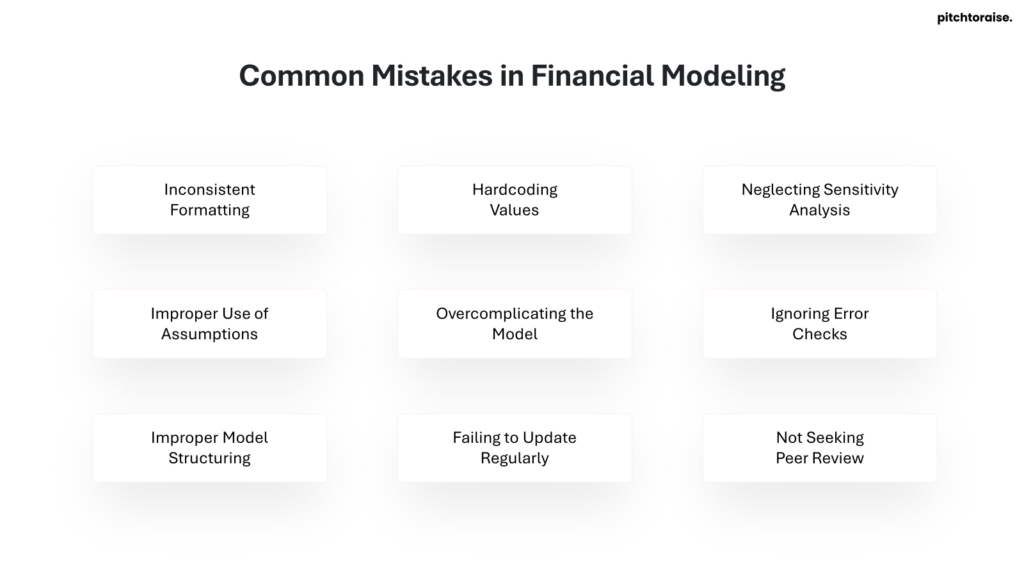

Common Mistakes in Financial Modeling

Financial modeling is an intricate process that requires precision and attention to detail. However, several common mistakes can compromise the integrity of the results:

- Inconsistent Formatting: One of the first pitfalls in financial modeling is inconsistent formatting. This includes inconsistent use of fonts, colors, and cell styles, which can make the model challenging to interpret. Maintaining uniform formatting aids in readability and enhances the usability of the model.

- Hardcoding Values: Inserting fixed numbers directly into the model, rather than using cell references or formulas, is a frequent mistake. Hardcoding complicates the updating process and increases the risk of errors.

- Neglecting Sensitivity Analysis: Many financial models fail to include sensitivity analysis to test different scenarios. Ignoring this analysis limits the model’s robustness and fails to highlight key assumptions and their impacts on outcomes.

- Improper Use of Assumptions: Assumptions are the foundation of a financial model, but poor documentation or unrealistic assumptions can lead to significant inaccuracies. Clearly outlining all assumptions and ensuring they are realistic is crucial.

- Overcomplicating the Model: While thoroughness is important, making the model overly complex can be detrimental. A complicated model with unnecessary details may obscure critical insights and is more prone to errors.

- Ignoring Error Checks: Without error checks, the risk of unnoticed mistakes increases. Error-check mechanisms, such as auditing tools, help identify discrepancies and correct them before they propagate through the model.

- Improper Model Structuring: How a model is structured affects its functionality. A well-structured model segregates inputs, calculations, and outputs, enhancing clarity and ease of modification.

- Failing to Update Regularly: Financial models should be kept up-to-date with the latest data and assumptions. Neglecting to update the model periodically diminishes its relevance and accuracy.

- Not Seeking Peer Review: Relying on a single individual’s work without peer review can result in overlooked errors. Instituting regular reviews by different stakeholders can enhance accuracy and reliability.

“Financial modeling is both an art and a science, requiring constant vigilance to avoid common pitfalls.”

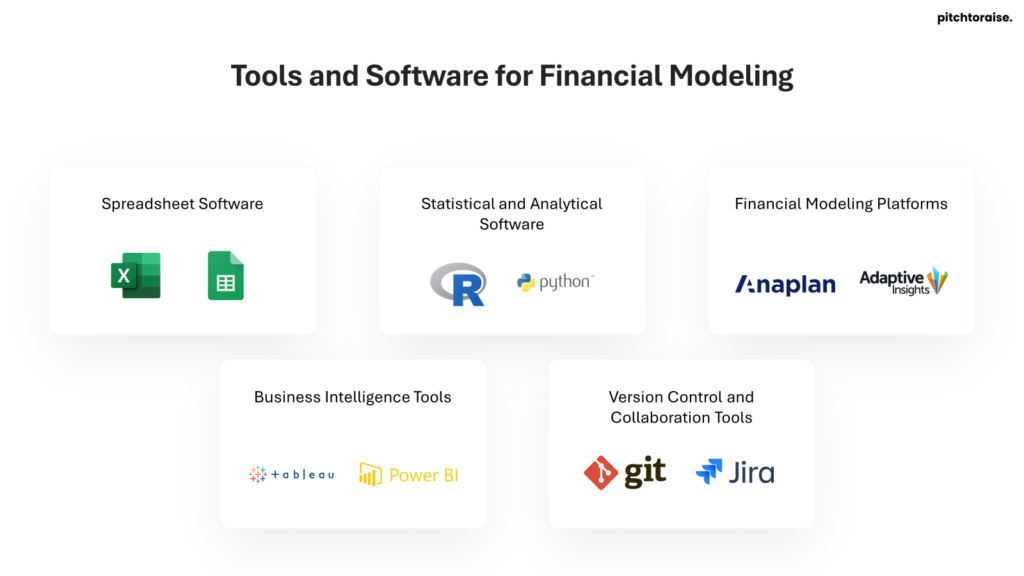

Tools and Software for Financial Modeling

Effective financial modeling relies heavily on various tools and software that enhance efficiency, accuracy, and functionality. These tools cater to different aspects of financial modeling, such as data analysis, visualization, and complex calculations. These softwares help to build financials model efficiently and in a more structure manner.

Spreadsheet Software

- Microsoft Excel: Predominantly used in financial modeling, Excel offers extensive capabilities, including pivot tables, VLOOKUP, and various financial functions. Excel’s flexibility allows modelers to build customized models tailored to specific business needs.

- Google Sheets: As a cloud-based alternative, Google Sheets supports real-time collaboration, making it a viable option for teams working on financial models. It includes similar functionalities as Excel but is preferred for its ease of sharing and accessibility.

Statistical and Analytical Software

- R: An open-source programming language ideal for statistical analysis and data manipulation. R is helpful in risk modeling, regression analysis, and other statistical functions where thorough data analysis is required.

- Python: Known for its simplicity and versatility, Python supports financial modeling through libraries such as Pandas for data manipulation, NumPy for numerical operations, and Matplotlib for plotting and visualization. Python is instrumental in automating complex tasks and integrating financial models with large datasets.

Financial Modeling Platforms

- Anaplan: A cloud-based platform specializing in financial planning and analysis. Anaplan offers real-time updates and collaboration features, making it highly suitable for large organizations requiring dynamic models.

- Adaptive Insights: Renowned for corporate performance management, Adaptive Insights streamlines financial modeling processes with its user-friendly interface and powerful forecasting capabilities. The software supports scenario analysis and long-term planning.

Business Intelligence Tools

- Tableau: A leading data visualization tool that integrates seamlessly with Excel and other data sources. Tableau allows modelers to create interactive dashboards and visualizations, making it easier to interpret and communicate financial data.

- Power BI: Microsoft’s business analytics service that provides interactive visualizations and business intelligence capabilities. Power BI’s integration with Excel ensures data consistency and enhances the overall modeling experience.

Version Control and Collaboration Tools

- Git: A version control system useful for tracking changes in financial models, especially when using scripting languages like Python or R. Git supports collaboration among multiple users, ensuring model integrity and version history.

- Jira: A project management tool that helps track tasks, manage workflows, and ensure timely updates in financial modeling projects. With robust collaboration features, Jira is beneficial for teams working on extensive modeling tasks.

Best Practices for Effective Financial Modeling

To maximize the efficiency and accuracy of financial models, adhering to specific best practices is essential. These guidelines ensure the creation of robust, reliable, and easily interpretable models.

Clear Objective Definition

Establish the purpose of the model before starting. Whether it’s for valuation, forecasting, or financial analysis, a well-defined goal directs the model’s structure and complexity.

Simplicity and Clarity

Keep the model as simple as possible while meeting the objectives. Avoid unnecessary complexity. Simplified models are easier to understand, audit, and modify.

Consistent Formatting

Apply consistent formatting rules for all cells, rows, and columns. Use colors, bold, and italics judiciously to differentiate headings, inputs, and calculations.

Input and Assumption Transparency

Clearly label and separate inputs, assumptions, and calculations. Use a specific sheet for inputs and assumptions to facilitate updates and transparency.

Documentation and Comments

Include thorough documentation and comments within the model. Annotate complex formulas and outline the purpose of each section to guide users.

Scenario and Sensitivity Analysis

Incorporate scenario and sensitivity analyses to test assumptions and outcomes under various conditions. Use data tables and charts for clear visualization.

Iterative Review and Calibration

Regularly review and update the model. Use historical data to calibrate assumptions and validate the model’s accuracy continuously.

Error Checking and Validation

Implement error-checking mechanisms. Use built-in Excel functions, such as IFERROR, and conduct regular audits to identify and correct errors.

Data Integrity

Ensure data used in the model is sourced reliably and validated. Cross-check data inputs against original sources and maintain data integrity throughout the modeling process.

Version Control

Maintain version control to track changes and model evolution over time effectively. Avoid overwriting previous versions without saving backups.

“A good financial model is one that allows for easy modifications without compromising the integrity and accuracy of its outputs.”

By following these best practices, the reliability and usability of financial models are significantly enhanced, allowing for better decision-making and strategic planning.

Case Studies: Real-World Applications of Financial Models

Predictive Analytics in Retail

Walmart uses predictive analytics to manage its inventory efficiently. By deploying advanced financial modeling techniques, Walmart forecasts demand and reduces overstock and stockouts. This model integrates sales data, market trends, and seasonal variations, enabling Walmart to make data-driven inventory decisions. As a direct result, Walmart improves its supply chain efficiency and customer satisfaction.

Risk Management in Banking

JPMorgan Chase utilizes Value at Risk (VaR) models to assess the potential losses in its portfolio. VaR models help the bank understand the risk involved in different investment strategies. By simulating various market conditions, the bank prepares for potential financial downturns. This risk assessment leads to informed decision-making, allowing the bank to allocate capital more effectively while ensuring regulatory compliance.

Capital Budgeting in Manufacturing

General Motors employs Discounted Cash Flow (DCF) models to evaluate new projects and investments. DCF models estimate the value of potential investments by projecting future cash flows and discounting them to their present value. This rigorous financial analysis enables General Motors to prioritize projects with the highest net present value (NPV), optimizing its capital allocation and driving long-term profitability.

Portfolio Management for Asset Managers

BlackRock utilizes the Modern Portfolio Theory (MPT) to diversify its investment portfolios. MPT emphasizes the balance between risk and return, allowing BlackRock to construct portfolios that maximize returns for a given level of risk. By systematically diversifying assets, the firm mitigates risks without compromising on potential gains, thereby attracting and retaining investors.

Conclusion and Future Trends in Financial Modeling

Financial modeling continues to play a pivotal role in modern business strategy, enabling organizations to understand, forecast, and navigate complex financial scenarios. Current advancements and future trends are shaping the way financial models are constructed, utilized, and interpreted.

Technological Innovations

- Artificial Intelligence and Machine Learning: These technologies are improving the accuracy and efficiency of models by analyzing vast data sets and identifying patterns that manual processes might miss.

- Blockchain Technology: Enhances data integrity and security within financial models, ensuring transparency and reducing the risk of fraud.

- Cloud Computing: Offers scalable and flexible solutions, allowing models to be updated and accessed in real-time from various locations.

Enhanced Data Quality

- Big Data Integration: Merging diverse data sources improves the comprehensiveness and precision of financial models.

- Data Governance: Establishing standards for data quality and consistency ensures reliable model outcomes.

Regulatory Changes

- Compliance and Reporting Standards: Increasingly stringent regulations necessitate more detailed and transparent financial models.

- Sustainability Reporting: Models are increasingly incorporating environmental, social, and governance (ESG) criteria to meet regulatory demands and investor expectations.

User-Centric Approaches

- Visualization Tools: Enhanced visualization tools make financial models more intuitive and accessible to non-experts.

- User Experience (UX) Design: Designing models with the user in mind facilitates better decision-making and wider adoption across departments.

Continuous Learning and Adaptation

- Ongoing Training: Regular training ensures that financial professionals are equipped with the latest methodologies and technological tools.

- Adaptive Models: Models must be agile and capable of evolving with changing market conditions and organizational needs.

Globalization and Market Integration

- Cross-Border Trade: As businesses operate on a global scale, models must account for various economic, political, and regulatory environments.

- Currency Fluctuations: Incorporating strategies for managing currency risks becomes essential in global markets.

Ethical Considerations

- Transparency: Ensures that stakeholders understand the assumptions and methodologies behind financial models.

- Bias Reduction: Implementing ethical guidelines to minimize biases in model outputs.

Financial modeling is continuously evolving to address contemporary challenges and opportunities. By leveraging technological advancements, ensuring high-quality data, complying with regulations, adopting user-centric approaches, and focusing on ethical considerations, financial professionals can build robust models that support informed decision-making in an increasingly complex business world.